By Peter Kelly on 28 August 2018

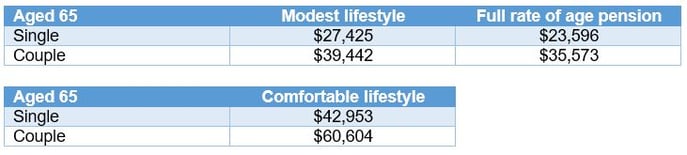

Regular readers will know that we often refer to the costs of living in retirement published by the Association of Superannuation Funds of Australia and known as the ASFA Retirement Standard. The figures are updated every three months to take into account movements in the general cost of living.

The latest figures for the June 2018 quarter have just been released. They show a small increase in the overall costs of living in both the ‘modest’ and ‘comfortable’ lifestyles for retirees.

Just to recap, the budgets published assume that a retiree owns their own home and is otherwise free of all debts, including car loans, credit, and store card debts, and the like.

A modest retirement lifestyle is just marginally better that could be supported by the full rate of age pension.

On the other hand, the more aspirational comfortable lifestyle allows older, healthier retirees a good standard of living allowing them to purchase a range of items including household goods, private health insurance, good internet access, quality clothes, a reasonable car, domestic, and the occasional overseas holiday. There is money to allow access to a broad range of leisure and recreational pursuits.

The figures provided by ASFA are a guide.

Naturally, if you see a place for extensive regular international travel, an expensive car, or you want to continually shower your grandchildren with gifts, or pay for their private school education, then retirement will cost potentially a lot more! It is a case of ‘horses for courses’.

So, how do the latest figures stack up? I have included the full rate of age pension for a comparison.

The figures shown are for a full year.

Notwithstanding health and aged care costs, as people age, their living costs tend to reduce. ASFA estimates that for a single person, or couples, their living costs will reduce by around $2,000 per year, or $4,000 for a couple living a comfortable lifestyle, from around the age of 85,

For those of us approaching retirement, the big question is: ‘how much money do I need to support my preferred lifestyle?’

In their research, ASFA has gone to the trouble of estimating the amount of money that will need to be available to fund the retirement lifestyles.

For those living a modest lifestyle, and assuming they don’t have significant investments and other assets, will generally qualify for the full rate of age pension. That being the case, both a single person and a couple will only need around $70,000 of investable funds to make up the shortfall over the age pension.

However, anyone aspiring to live a comfortable lifestyle is going to need more.

Whether savings are held in superannuation, or invested outside super, a much larger sum will be required to support the lifestyle. And, as savings increase, the rate of age pension reduces due to the impact of the assets test.

A single person will need around $545,000 of investable funds, and a couple will need $640,000 between them if seeking a comfortable retirement lifestyle.

If a couple has $640,000 in super and their other assessable assets were relatively modest, they would still receive around $12,750 of age pension between them. They would, therefore, be drawing down approximately $47,850 from their super each year to support a comfortable lifestyle.

However, a single pensioner with $545,000 in super will not qualify for any age pension. Therefore, they will be relying on their own resources to provide for their retirement income.

Living in retirement is all about choices.

However, these choices will often be influenced by the decisions we make during our working life. Whether we choose to save and put more money in super or spend everything we earn on our journey towards retirement, will dictate what our retirement will look like. Sadly, many people find that once they retire, there simply isn’t enough money to allow them to live the lifestyle they have always dreamed of.

However, there are strategies and options that can be employed to give us all a much better chance of achieving our desired lifestyle. We will cover those in a future blog.

comments