By Peter Kelly on 27 May 2022

Way back in the dim, dark past – 2017 to be exact – the Government announced an initiative designed to reduce the pressure on housing affordability for Australian families.

The initiative, which came into effect on 1 July 2018, focussed on allowing older Australians – those aged 65 or over – to contribute up to $300,000 (and up to $600,000 for a couple) of the proceeds from the sale of an “eligible dwelling” to superannuation without being constrained by the usual age limit, work test, and contribution cap restrictions.

Downsizer contributions, as they are known, are subject to several conditions including a requirement the home must have been the owner’s main residence for at least part of the time, and the home must have been owned for at least 10 years.

Since downsizer contributions first became available in July 2018, $9.4bn has been channelled into the superannuation system[1].

One of the eligibility criteria for making a downsizer contribution is the requirement a person must be aged 65 or older at the time they make their contribution. In the 2021 Federal Budget, the Government announced plans to reduce this to 60 from 1 July 2022. This change has been legislated.

In its 2022 Federal Election campaign launch on 15 May 2022, the Coalition announced plans to further reduce the age limit to 55, effective from 1 July 2022. At the time of writing (17 May 2022) the election has not been held so the outcome of a further age reduction is unknown.

While the ability for older Australians to contribute surplus proceeds from the sale of their former home to superannuation appears to have been a popular strategy, at least based on the number of technical enquires we receive from financial advisers, I am not convinced the strategy has fulfilled its intended purpose of making housing more affordable.

When first introduced, the assumption was that older Australians were living in large homes close to the city. These were homes that these same older Australians had raised their own families in and were now occupied by one or two people. The ability to sell the family home and purchase something a little cheaper and contribute surplus proceeds to superannuation seemed like a good idea at the time.

However, since 2018 Australia has seen a massive increase in the value of the residential real estate, not only in capital cities but also in regional areas.

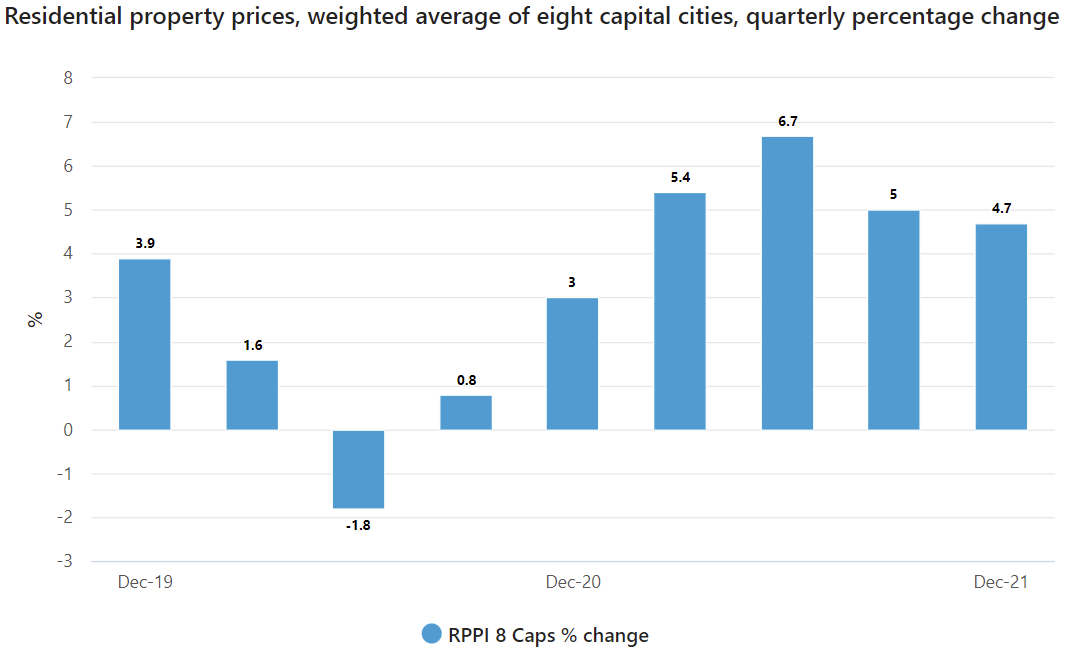

The following table illustrates what has happened, particularly in the eight capital cities:

Source: Australian Bureau of Statistics[2]

Australian housing prices have been driven by several factors with the largest no doubt being historic low-interest rates, readily available credit, and a raft of other state and federal government initiatives.

While the downsizer contribution initiative presents a wonderful opportunity for older Australians to get more money into super to help fund their retirement income needs, I doubt it has achieved its purpose of making housing more affordable.

Selling a family home is often more of an emotional decision rather than one purely driven by financial reasons. Family homes come with years of memories and are often located close to services, facilities, and established networks of friends and family.

If a decision is made to sell the family home, the ability to make a downsizer contribution may be a bonus. But it should not be the primary driver.

[1] Senator Jane Hume – Video address to the SMSF Association National Conference – April 2022

[2] https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/residential-property-price-indexes-eight-capital-cities/latest-release

comments