By Mark Teale on 30 October 2019

Does paying taxes while you’re working give you the right to expect you will receive an age pension when you decide that you no longer want to work – in other words, retire?

The short answer is no.

What is the age pension?

The age pension is a safety net to support people in retirement who do not have the necessary financial resources to either fully support or partially support themselves.

I am not going to argue the rights and wrongs of this model. Opinions can vary substantially, and the purpose of this blog is not to push a personal opinion but to educate people thinking about, preparing for, or already in retirement.

When can I access the age pension?

Assuming you were entitled to receive the age pension, at what age does a person qualify for an age pension?

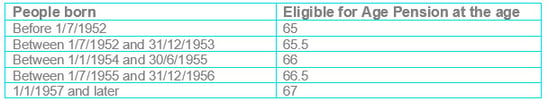

For over 100 years, the qualifying age for the age pension was 65. In 2017 the qualifying age increased by six months and will continue to increase by six months every two years until 2024, when the qualifying age will reach 67..

The following table provides a more comprehensive overview.

Taking myself an example, I was born on 20 of August 1956. The relevant qualifying age when I might be able to access the age pension is 66.5, which will be on 20 of February 2023. However, age alone doesn’t entitle you to the age pension.

How do I know if I am entitled to an age pension?

This is a complicated question which is very dependent on a person’s situation – are you single or a member of a couple, do you own your home or are you renting, how much do you have in assets and what is your income?

The current full age pension is $933.40 per fortnight for a single person or $703.50 per fortnight for each member of a couple. This full age pension is adjusted twice a year - in March and September.

A person’s entitlement to the full pension is, as I have previously mentioned, dependent on their assets, the income generated from these assets or if they do happen to be still working.

The age pension entitlement is calculated under both an assets test and an income test.

Why is the age pension assessed under both tests? If a person’s entitlement is less under the assets test, then what may be payable under the income test, their entitlement is determined by the assets test as this test pays the lower age pension.

In the coming weeks, I will provide a more detailed overview of how the assets test and the income test are applied.

In addition to a person’s age, their assets and income, a person applying for the age pension also needs to meet a residency requirement - you must be an Australian resident, and in Australia on the day the claim is lodged. You also need to have been an Australian resident for a continuous period of 10 years or have resided in Australia for a number of periods that total 10 years with at least five of these years in one continuous period.

Australia does have international social security agreements with a number of countries and residence in these countries may count towards your qualifying Australian residence.

As you can see, qualifying for the age pension is not as simple as turning a certain age. It is complicated, and I would urge readers who are unsure of their entitlement to talk to an expert to ensure you do receive the right entitlement when you apply.

comments