On 23 July 2018, the Financial Adviser Standards and Ethics Authority (FASEA) released Consultation Paper 5: Professional Work & Training Requirement (Professional Year).

The consultation paper provides guidance on the Professional Year program that is required to be completed by all new entrants to the industry. New entrants are those who register on the Financial Adviser Register post 1 January 2019.

The paper also proposes that existing advisers who take more than a two year career break will have to complete “appropriate CPD”.

To be clear – if an adviser is currently registered on the ASIC Financial Advisers Register, or will be before 1 January 2019, the only part of this draft standard that applies to them is the CPD proposal when they take a career break of more than two years. Existing advisers who are interested in the CPD proposal for re-entering the industry after a career break should see the CPD section below.

Proposed new entrant’s Professional Year program

What will new entrants be called during their Professional Year?

- The new entrant is intended to be known as a ‘Provisional Financial Adviser’. They will not be allowed to call themselves a ‘financial adviser’ or ‘financial planner’ until they have meet the Exit Criteria – set out below.

- Please refer to FASEA Consultation 4: Provisional Relevant Provider Term for more on FASEA’s reasons for preferring this term over others.

Supervisors

- The role of the supervisor is to provide appropriate supervision, including approving in writing any Statement of Advice (SoA) provided to a retail client during the relevant year.

- The new entrant will be required to be supervised by an adviser registered on the Financial Adviser Register who has a minimum of two years’ experience.

Before a person can commence the Professional Year program

- New entrants are required to have completed their Bachelors’ degree and passed the financial adviser examination prior to the commencement of their Professional Year.

Hours to be completed during the program

- The Professional Year program is based on one year full time employment, including 1800 hours split between:

- 800 hours of education and training

- 1000 hours of work and supervision

- Formal education that leads to further qualifications is a preferred

Competencies

- While completing their Professional Year, new entrants will not be required to comply with the continuing professional development (CPD) standard that FASEA will issue guidance on later this year.

- Competencies will be based on the following criteria:

- Technical competence

- Client care and practice

- Regulator compliance and consumer protection

- Professionalism and ethics

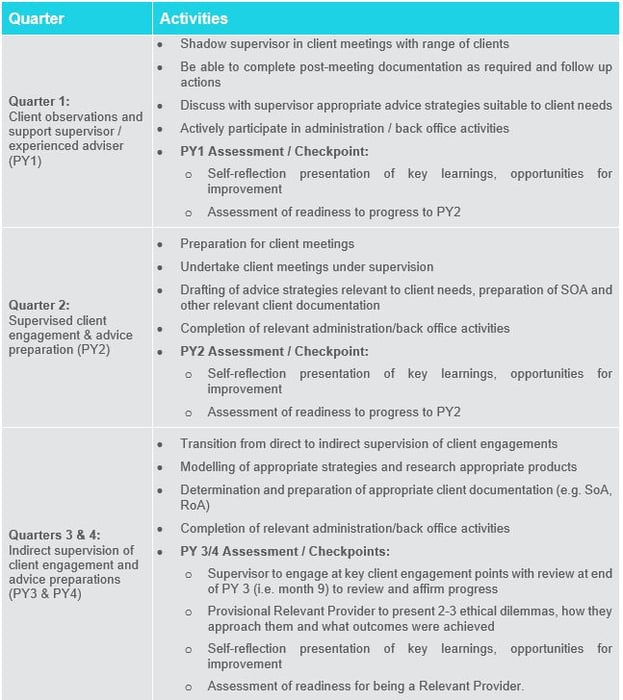

Records and proposed program structure

- A Professional Year logbook (PY logbook) will be required to be maintained

- A quarterly approach to supervising will be taken with the following needing completion to progress beyond the first and second parts of the program:

- FASEA has yet to confirm whether it will provide resources and templates for the Professional Year record keeping requirements, but has said it may provide templates of the following:

- A quarterly activity guide

- A PY logbook

- Supervisor attestation form / report.

Exit criteria

- To demonstrate they have completed their Professional Year program satisfactorily (and can therefore legally begin calling themselves ‘financial adviser’ or ‘financial planner’), a Provisional Financial Adviser Licensee will have to ensure that:

- the Provisional Financial Adviser has completed all PY1, PY2, PY3 and PY4 activities – likely through a PY logbook in approved form being completed,

- the Supervisor provides attestations to confirm the Provisional Financial Adviser has completed the Professional Year program, and

- the Licensee must also confirm that it has:

- conducted an audit on five client files prepared by the Provisional Financial Adviser, and

- reviewed that all relevant work and training requirements have been met. This will likely be a part of the ASIC Register form for Licensees to complete in order to change the Provisional Financial Adviser’s register entry.

Completion of CPD to re-enter the industry after a career break

As noted above, the consultation paper also proposes that after 1 January 2019 a financial adviser can only re-enter the industry after taking a career break longer than two years if they “undertake appropriate CPD to ensure they are equipped with the latest regulatory and licensee requirements”.

FASEA have not confirmed what “appropriate CPD” will be nor what constitutes a “career break” and unfortunately, FASEA’s proposed CPD Standard does not clarify the issue.

At this stage, FASEA is only seeking feedback on whether requiring completion of “appropriate CPD” to re-enter after a career break longer than two years is appropriate for them to issue guidance on.

Feedback

FASEA welcomes feedback and submissions to assist in finalising the development of the Professional Year requirements. Submissions can be directed to consultation@fasea.gov.au by 5pm 17 August 2018.

Should you have any queries in relation to the Professional Year requirements please contact education@cpal.com.au or alternatively contact your local Professional Standards Consultant.

.png)