Why do you do what you do? Simon Sinek, author of Start with why: How great leaders inspire everyone to take action, said, “Very few people or companies can clearly articulate WHY they do WHAT they do. When I say WHY, I don’t mean to make money—that’s a result. By WHY I mean what is your purpose, cause or belief? WHY does your company exist? WHY do you get out of bed every morning? And WHY should anyone care?”

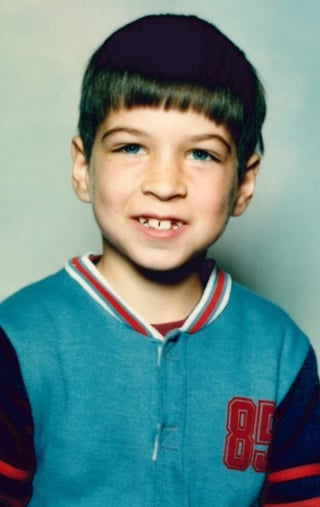

Centrepoint’s ‘why’ is to partner with financial advice firms to achieve their business goals. But what makes the people at Centrepoint get out of bed every morning? Over the next few months, we’ll be sharing some of these stories, starting with Ryan Goodfellow – National Growth Manager – who shares his journey from suburban Adelaide to a career in financial services.

The factors that shaped my life started coming together long before I was born. When the fiscal crisis hit Europe after World War 2, my grandparents fled Germany as ‘economic refugees’.

Australia had already set up an immigration program around this time and my grandparents saw it as an opportunity to build a better life for their children, away from the harsh conditions they were facing.

Settling in Adelaide, it was not too long after that my parents met as teenagers. A much shorter time after that, my mum found out she was pregnant. Unmarried, 17 years old, and with a baby on the way, my parents worked manual jobs to make ends meet.

We spent most of my younger years living in housing commission until they finally scraped up enough money to put down a deposit for a house and land package in Adelaide’s northern suburbs.

It wasn’t the best looking of homes but my parents were proud to finally have something to call their own. They spent whatever extra time they had on the weekends trying to fix it up – retaining walls went up, the garden was tended to, fences were built, and my dad even laid down all the floor tiles by himself.

I feel ungrateful saying this now, but it took a long time before I brought friends over. I was too embarrassed for anyone to see our humble home until my parents got it to look nicer.

I was energetic and causing havoc from an early age.

Rather heartbreakingly, my parents’ optimism was squashed a few years after they had begun their home ownership journey. Just as they got the house to look half decent, Paul Keating announced that Australia was about to go through the ‘recession we needed to have’. Interest rates went up to around 19% and for my parents, who had barely managed to put together the minimum deposit, this was crippling. Both my parents had to take second jobs just to keep the house. Thankfully my grandparents didn’t live too far away and became my regular caregivers while my parents were at work.

It was around this time I realised the power money had and decided I wanted to be as close to where money was as possible.

I started reading money management books as young as ten and went through the real estate pages from back to front every Saturday.

Being studious, I graduated year 12 in the top 5% of the state and had the opportunity to go to university. At the time, I was the first member of my family to get a place in university straight out of high school. A number of family members, including my mum, have earned their degrees and diplomas since then.

My grandparents have played a special role in my life.

In 2006, I was in my first year as a financial planner at Westpac and on my way to earning an income that my parents could only have dreamt of. However, something was still missing.

Despite my successes up until that point, my real ‘aha’ moment came when I met Donald. Donald was a 63-year-old Dutch Seychelles immigrant to Australia who had spent the past 40 years working as a Nutelex truck driver in Melbourne. In Donald, I saw the dreams of my grandparents and parents. The hope that by working hard, he would have a chance to retire one day with enough money to enjoy the fruits of his many years of labour.

He was initially sceptical of making an appointment with me since he had seen three financial advisers in the 15 years prior to us meeting. Each of the advisers had put him into expensive managed fund products where they reaped big upfront entry fees, which was the model at the time.

Donald had a good corporate superannuation plan and after a bit of convincing from our customer service representatives, he agreed to discuss his super.

I spent the first couple of appointments trying to make him feel comfortable and really encouraging him to share what his true goals for retirement were. I focused on understanding his motivations and by the end of the second meeting, I felt comfortable that I knew what he wanted to achieve.

As an only child, I spent a lot of time reading books about wealth management.

Although we had been talking, Donald was still anxious at our plan presentation meeting. He seemed nervous as I took him through his current situation. However, that changed quickly when I told him he could retire tomorrow based on his expenses and assets in super along with pension payments.

I was moved beyond anything I had experienced before as Donald broke down in tears. I’ve always done my best to be as professional as possible, but in the moment, I felt the tears run down my cheeks and I reached out and hugged him.

Even though I had gone through so much to get to where I was, it was in that moment with Donald that I knew I had found my ‘why’. I’d found a calling in life that would not just help me make a living but also add value to people’s lives.

My ‘why’ has evolved over the years. It started with purely wanting money, having witnessed my parents battling to put a roof over our heads. But now it’s so much more than that. I’m proud to work in financial services. I’m proud of how hard I’ve worked to build the life I have. But most importantly, I’m proud to help give people peace of mind at times when they feel most vulnerable and overwhelmed.

Now that you know my ‘why’, why do you do what you do?

Like what you’ve read? Sign up to get Viewpoints delivered straight to your inbox.

If you’re ready to chat, book an appointment with Ryan here.

.png)