Financial advisers work with clients every day to articulate their goals and aspirations and then formulate a plan to achieve them. Yet, they struggle to plan for their own retirement and often don’t end up realising the full value of their own business when they retire.

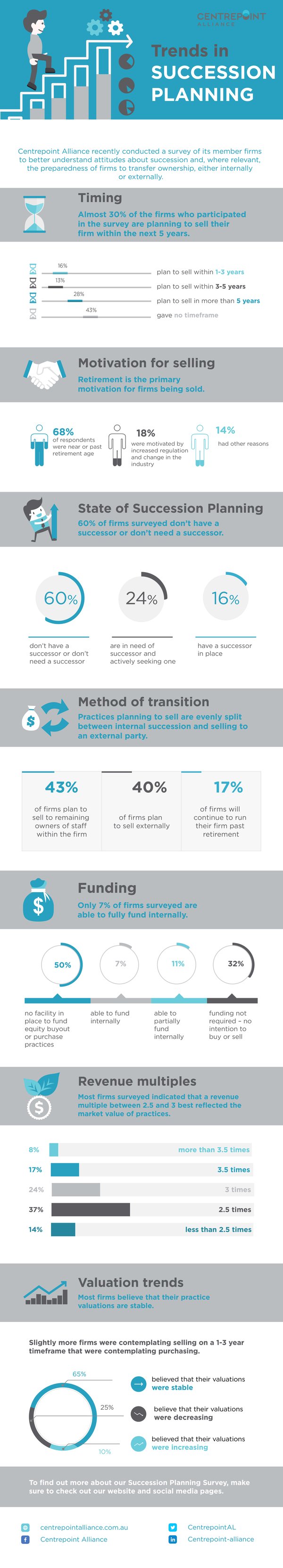

Recently Centrepoint Alliance conducted a survey of its member firms to better understand attitudes about succession and, where relevant, the preparedness of firms to transfer ownership, either internally or externally.

Let’s dig a little deeper into what we found.

Timing

- 16% plan to sell within 1-3 years

- 13% plan to sell within 3-5 years

- 28% plan to sell in more than 5 years

- 43% no timeframe provided

Almost 30% of the firms who participated in the survey are planning to sell within the next five years. Approximately 20% of respondents were over the age of 65 and a further 35% were aged between 50 and 59 so the proportion of firms planning to sell, while surprising at face value, is consistent with the demographics of the broader adviser population.

Motivation for selling

- 68% near or past retirement age

- 18% increased regulation and change in the industry

- 14% other reasons

For those firms contemplating selling, retirement is the prime motivation. Interestingly, despite the amount of regulatory change over the past five years, only 18% nominated increased regulation and change in the industry as drivers for selling their business.

State of Succession Planning

- 60% don’t have a successor or don’t need a successor

- 24% are in need of a successor and are actively seeking one

- 16% have a successor in place

Despite almost 30% of firms planning to sell within five years, only 16% of all respondents (including those that plan to sell in more than five years or did not provide a timeframe) have a successor in place. This suggests that more than half of those firms seeking to sell either don’t have a natural successor in the business or are yet to identify one.

Method of transition

- 43% plan to sell to remaining owners or staff within the firm

- 40% plan to sell externally

- 17% will continue to run firm past retirement

In terms of who firms and principals are intending to sell to, it is split evenly between internal succession and selling to an external party. 17% of respondents intend to continue servicing their clients into retirement, retaining income with a diminished workload.

Funding

- 50% have no facility in place to fund equity buyout or purchase practices

- 7% are able to fund internally

- 11% are able to partially fund internally

- 32% do not require funding– no intention to buy or sell

Adjusting for firms who don’t intend to buy or sell, only 25% of firms are able to internally fund either in part or whole a purchase of equity from a retiring principal or a practice or book in the marketplace. Given roughly half of firms intending to sell plan to do this internally, funding is likely to be a major issue facing firms and principals.

Valuations

- 50% selected multiple of revenue

- 23% selected multiple of earnings

- 27% are undecided

The majority of firms surveyed believe that a multiple of revenue is the most appropriate measure of practice valuations. Broadly speaking, a multiple of revenue is still widely used for book sales and businesses valued at below $1 million. Around half of the firms that responded to the survey estimated the value of their firms to be $1 million or less.

Revenue multiples

- 8% indicated more than 3.5 times

- 17% indicated 3.5 times

- 24% indicated 3 times

- 37% indicated 2.5 times

- 14% indicated less than 2.5 times

The majority of respondents indicated a revenue multiple between 2.5 and 3 best reflected the market value of practices. In terms of EBIT multiples there appeared to be some confusion between EBIT and recurring revenue. Adjusting for this, most respondents had valuations between 4 and 5.5 times earnings.

Valuation trends

- 65% believed valuations were stable

- 10% believed valuations were increasing

- 25% believed valuations were decreasing

Clearly most firms believe that practice valuations are stable. Interestingly, within the survey slightly more firms were contemplating selling on a one to three year time frame than were contemplating purchasing. There is a general view in the market that the supply and demand for firms has become more balanced recently after a long period where buyers outnumbered sellers. Survey results provide some support for this view.

For a confidential discussion on succession planning, please submit the Join Us form to learn how we can leverage our business partnerships to provide business valuations, consulting services, finance options and business broking services.